(KNSI) – Dozens of St. Cloud area residents tuned in for a listening session with a local lawmaker on the Democrat’s proposed budget for Minnesota.

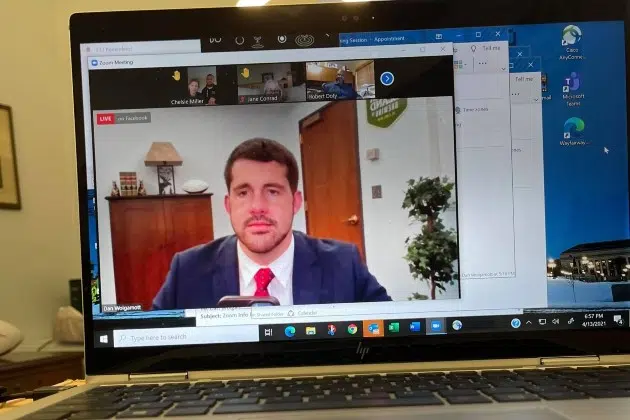

St. Cloud Reprsentatnive Dan Wolgamott says he’s interested in what the people want to be funded as the Minnesota Legislature starts to finalize the budget.

“I’m fighting hard for a budget that meets the needs of the people of St. Cloud, and hearing directly from my constituents, as we’re in the midst of this sausage-making process, and really make sure that the decisions I’m making over these next few weeks and in the budget that we pass are rooted directly in the needs of the people of St. Cloud.”

The Assistant Majority Leader says he wants to make sure the budget prioritizes those who COVID-19 most impacts.

Wolgamott says he heard from community members about how hard the pandemic has been on school children’s mental health, and funding needs to be there.

“My big takeaway is, we need to make sure we are asking those at the top, the millionaires, the multinational corporations, to pay more. So, that we can prioritize our student’s priorities, our teachers, that’s what I’m going to be fighting for with the governor.”

He says the top priority is to pass a tax increase on the wealthy to offset a $500 tax cut for poor and middle-class families.

The budget would create a fifth income tax rate of 11.15% on income above a million dollars.

“So for those listeners, who are millionaires who do rake in millions of dollars every year, I’m sorry if this offends you. But I think you should be able to chip in for every dollar you make above a million dollars. You should be able to chip in about 11 cents more so that we can have good schools so that we can have safe communities,” said Wolgamott. “And if you’re a multinational corporation, which filters profits and offshore tax havens, like Bermuda and the Cayman Islands, again, sorry to offend you, but I think that’s garbage. I think that you should have your profits here in Minnesota, and being a patriotic person and chipping in so that we can fund these things are going to help Minnesotans get through this pandemic and thrive afterward.”

Submitted by Dan Waolgamott’s Office

He says the tax increase on millionaires would bring around $303.6 million a year to the budget, and closing the corporate loophole would generate about $229.6 million a year.

The Minnesota DFL Party has proposed a $49.1 billion budget.

It includes aid for small businesses that didn’t get to take part in the Paycheck Protection Program.

The bill would tax-exempt PPP loans for 90% of recipients. It would require an addition for associated expenses above $350,000 per loan.

Here are some other key elements:

It would conform to the tax provisions in five federal acts that have become law since December 2019, resulting in a loss to the state’s General Fund of $341.4 million in the fiscal year 2022. The PPP loan forgiveness changes would decrease state revenues by $220.4 million in fiscal 2022;

There would be county relief grants for local businesses and nonprofits of $69.7 million in the fiscal year 2022;

A new homelessness prevention fund would provide $25 million in annual aid to counties beginning in the fiscal year 2023;

The Housing Development Fund and Workforce and Affordable Homeownership account would receive $15 million between them in the fiscal year 2022;

It would allow $10 million to be allocated for the small-business investment credit, or “angel credit,” for the tax year 2022 and extend its sunset by one year;

The market value exclusion on the statewide property tax would increase from $100,000 to $150,000;

Minnesota’s tobacco tax would expand to include electronic vapor devices.

And the bill contains all of the local taxes and tax increment financing provisions included in the Property Tax Division report.

The Minnesota Republican Party Budget is $51.9 billion and includes tax relief through the Paycheck Protection Program (PPP) loan tax conformity and Unemployment Insurance tax elimination for COVID.

Extending the Reinsurance Program and the Law Enforcement Operations Account.

The budget does not consider the recently passed federal stimulus “American Rescue Plan,” which provides $2.6 billion to the state, much of which can only be used for one-time spending.

Highlights include:

40% of the budget is for E-12 education:

$19.8 billion total to fully fund the February forecast budget

Funding to close racial and financial disparities through literacy, for teachers of color programming, and improve student mental health.

Education Scholarship Accounts to give parents and students a choice in their schooling

31% of the budget is for Healthcare

$13.7 billion meets the February budget forecast

$100 million in cost savings from targeted reforms

Shoring up the Health Care Access Fund for low-income access

$591 million for the tax relief:

Employer relief through PPP conformity

Employee relief on COVID unemployment benefits during the pandemic

Tax relief to stimulate economic growth and support families

No income tax increases

The State Government budget includes a 5% reduction in administrative costs.

$216 million increase for transportation without a gas tax or tab fee increase

Jobs and Economic Development has an additional $100 million over the

February forecast to help recovery from COVID unemployment

$40 million for broadband included in Agriculture budget

No new taxes

No Defunding of Police

No Felon Voting

No MN Green New Deal

No OneCare