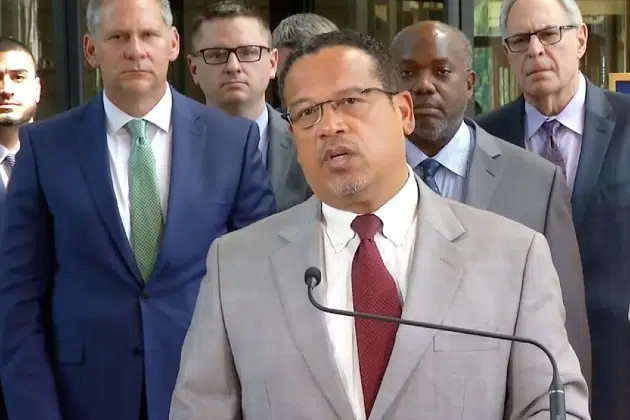

(KNSI) – Attorney General Keith Ellison is hailing the passage of House File 4077 because it includes several provisions of the Minnesota Debt Fairness Act.

Ellison has long pushed for the measures tucked inside this year’s Commerce Policy Omnibus bill. They include a ban on automatically transferring medical debts to a patient’s spouse. In a press release, they cite a growing trend of people turning to divorce to avoid the medical debt penalty.

The bill would also hide medical debt from credit bureaus. Proponents of the move argue that medical expenses are not a choice like discretionary purchases such as clothes, vacations, and other items people traditionally pay for using credit cards.

Another provision would protect consumers by allowing them to carry a minimum amount in their bank account that would be protected from debt collectors. Neighboring states like North and South Dakota and Wisconsin all have similar laws. The bill would mandate that $4,000 per bank account would be sheltered.

Lastly, garnishments would be capped at 25% of a person’s income for high earners. As incomes drop towards the poverty line, the percentage of wages that can be used for debt repayment falls to only 5%.

HF 4077 was passed by the Minnesota House late Monday.

___

Copyright 2024 Leighton Media. All rights reserved. This material may not be broadcast, published, redistributed, or rewritten, in any way without consent.