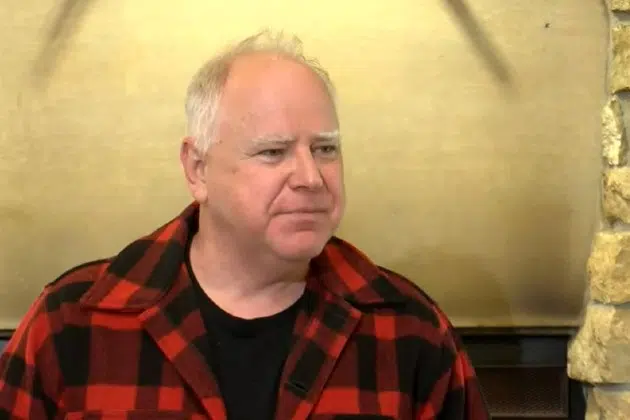

ST. PAUL, Minn. (AP) — Gov. Tim Walz sharply criticized the Minnesota Legislature on Wednesday for failing to break its impasse over an unemployment insurance tax increase that businesses are already starting to pay.

The Democratic governor blamed both the Senate Republican and House Democratic majorities, saying it’s “absolutely ridiculous” that they didn’t reach a deal soon after the legislative session began in January. He said they need to pick up the pace with the May 23 adjournment coming up in just over four weeks, and said he’ll propose a path forward in his State of the State speech on Sunday.

Employers across Minnesota started getting bills for higher first-quarter unemployment insurance taxes soon after legislative leaders failed to agree by the March 15 deadline for heading off an automatic increase.

The increase kicked in because the state must replenish its unemployment insurance trust fund, which has been depleted by the pandemic. The state can tap over $1 billion in federal COVID-19 relief money and the state’s $9.25 billion budget surplus to raise the necessary $2.7 billion. But House Democrats have made a tax rollback contingent on Senate Republicans agreeing to $1 billion in “hero pay” for frontline workers instead of the $250 million target all sides set last year.

Walz said lawmakers could have settled it all back in January.

“This should have been the easiest deal in Minnesota political history,” Walz said during a visit to a Cub Foods supermarket in north Minneapolis to talk about his tax rebate proposal.

Doug Loon, president and CEO of the Minnesota Chamber of Commerce, told reporters at the Capitol that his group shares the governor’s frustrations.

Democratic House Speaker Melissa Hortman has said the real deadline is April 30, when the first tax bills reflecting the increase come due.

Walz and Loon both said some companies have already paid those bills. And Walz said he hopes the frustrations of those employers prods lawmakers into a deal.

Loon said the businesses he represents are universally reporting double-digit or higher increases in their unemployment insurance tax bills when they’re already struggling to be competitive.

“Other states have fixed this. And Minnesota as an outlier state needs to be competitive,” Loon said. “If we don’t fix this, Minnesota businesses are at a disadvantage.”

Walz spoke as the Chamber coincidentally held its annual lobbying day at the Capitol. Loon said around 100 of his members fanned out to meet with their local lawmakers and tell them how the tax increase was affecting them.

They included Frank Soukup, marketing director for Grand View Lodge resort in Nisswa. He said the hike was about 15% for his company, which employs over 850 people during a normal summer, at a time when it and other hospitality businesses are already having trouble hiring enough workers.

Walz went to the supermarket to promote his proposal for income tax rebates to give part of the $9.25 billion budget surplus back to taxpayers. He’s dubbed his proposal “Walz Checks.” It calls for rebates of $500 for single filers and $1,000 for joint filers.

The idea has received a cool reception from the Legislature. Senate Republicans want to use most of the surplus for permanent income tax cuts. House Democrats want targeted tax relief through expanded child care and property tax credits and refunds, plus more spending on education and other programs. Walz is hoping his rebate plan could emerge as a compromise to bridge the gap.

Standing in the produce section, flanked by full grocery carts, Walz said taxpayers could use their rebates to pay for food, diapers, gas, rent or even vacations.

“It’s ‘go’ time at the legislative session. It is time to get these things done,” Budget Commissioner Jim Schowalter said.

(Copyright 2021 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.)

Latest News