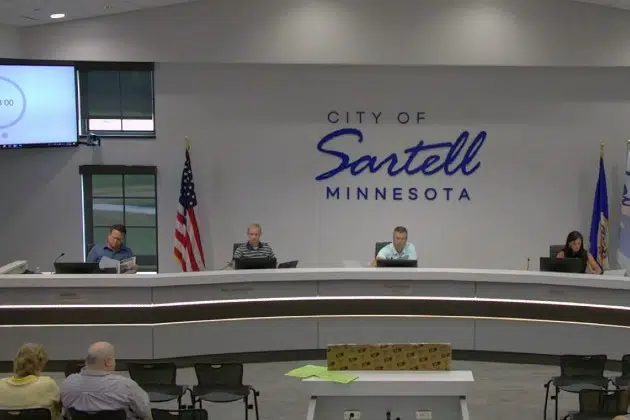

(KNSI) – The Sartell City Council unanimously approved a special election to vote on a 1.5% sales tax for food and beverages sold in the city. Sartell officials say the sales tax would be added to food and alcoholic drinks sold at restaurants, bars, coffee shops, fast food and delivery from restaurants.

If passed, the food and beverage tax can only be used to pay for improvements, operating costs and future amenities. A person would pay about $0.75 on a $50.00. Sartell expects to tax to bring about $315,000 a year.

According to a press release, the tax will let Sartell capitalize on thousands of visitors who frequent Sartell establishments and purchase food or beverages.

The tax wouldn’t be collected by grocery stores, liquor stores, gas stations and general stores. The tax will be paid by customers and collated by businesses.

St. Cloud is the only other area city with a food and beverage tax. The 1% tax has been collected since 1987.